Massive Low Cost Housing Scheme: Namibia

Namibia Massive Low Cost Housing Scheme

The envisaged multi-billion dollar public housing programme that will see the construction of around nine thousand houses in the next three years will have no impact on FNB Namibia's revenue, CEO Ian Leyenaar has said. The housing development programme, understood to be a public private partnership between the government and institutional investors, including the country's biggest pension fund, GIPF, will see the servicing of municipal land, and the construction of low-cost housing in the country's informal settlements. About N$1.9 billion has already been allocated to the Ministry of Regional, Local Government, Housing and Rural Development for the 2013/14 financial year to cater for, among others, the servicing of land and improved sanitary standards in urban, peri-urban and rural areas while N$5.8 billion in total will be allocated over the Medium Term Expenditure Framework. Welcoming the move as a positive step, Leyenaar told the Economist on Wednesday that the public housing programme will have no impact on the bank's revenue despite home loans contributing 49% to FNB Holdings total revenue in the latest financial results announced by the financial services group recently. Leyenaar said: "The demand for housing is so great and the supply is so limited, and I think the project that government is initiating is a very worthy one. We are delighted to hear [of the programme] because as a country we need more housing. I think it is going to soften the market, but the demand will still maintain a relatively high thrust particularly at the entry level. I don't think it is going to materially alter the percentages where we are at the moment." However, the FNB CEO said it remains to be seen whether the massive public housing programme will actually deliver the number of houses that have so far been thrown around. FNB Namibia currently holds just under 40% share of the housing market in the country. Home loans have been lucrative business for local banks, and Leyenaar said very few people in the country default on their mortgage payments, a situation that has contributed to lower non-performing loans compared to other countries. FNB Namibia's ratio of non-performing loans to average gross advances has seen continued improvement in the last three financial years dropping from 1.9% in 2011 to 1.05% in the year ended 30 June 2013."It is very interesting that people in Namibia defend their houses. If there is one thing that they pay off, it is their housing, it's their core asset.

|

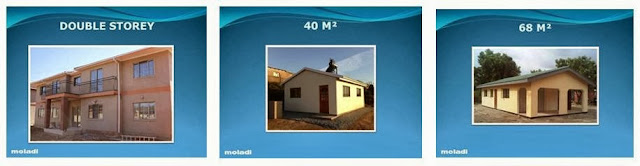

Low cost housing in Namibia |

Keywords: Low cost housing, Namibia, FNB, housing programme, home mortgages, demand, affordability, moladi, solution, Ministry of Regional, Local Government, Housing and Rural Development, Alternative Technology